Put options

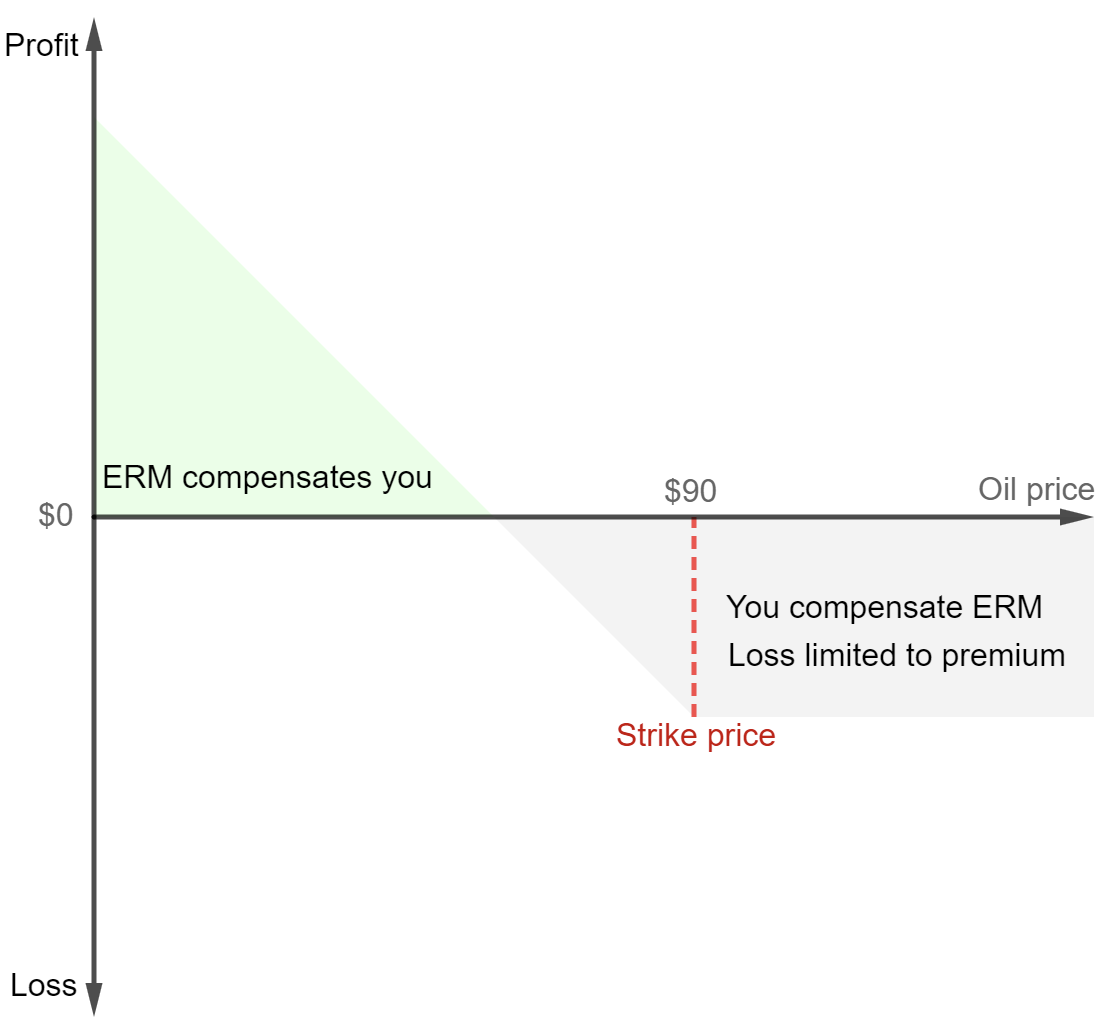

A put option contract gives the holder the right, but not the obligation, to sell an asset at a specific price on or before a specific date.

Example of how it works

You buy put options with a strike price of $90 per barrrel.

Scenario 1 – Oil prices increase: The price of oil increases to $100 per barrel. In that case, the put option may expire worthless, and you would not exercise it. You would lose the premium paid to purchase the option.

Scenario 2 – Oil prices decline: The price of oil decline to $80 per barrel. You can exercise your put option and sell oil at $90 per barrel, even though the market price is lower. This allows you to profit from the price difference between the market price and the strike price.

Before you open your financial hedging position, you first need to agree upon the floowing things:

⇒ A period for your hedging (E.g. six months)

⇒ A hedging volume for each month

⇒ The product that should be hedged

⇒ The trading currency (EUR, DKK, GBP, USD or contact for others)

⇒ A fixed price

ADVANTAGES AND RISKS

↑ Protection against a decrease in prices

↑ Creates predictability for your bottom line

↑ Potential upside if prices decrease

↓ No benefits for a increase in prices

Let us secure your bottom line

We are ready to assist with risk management of all kinds of energy products and services, so if your company’s budget is affected by energy price fluctuations, don’t hesitate to contact us!